what is considered income for child support in colorado

Be sure that you understand your rights and options when it comes to all aspects of your divorce. 2 number of children.

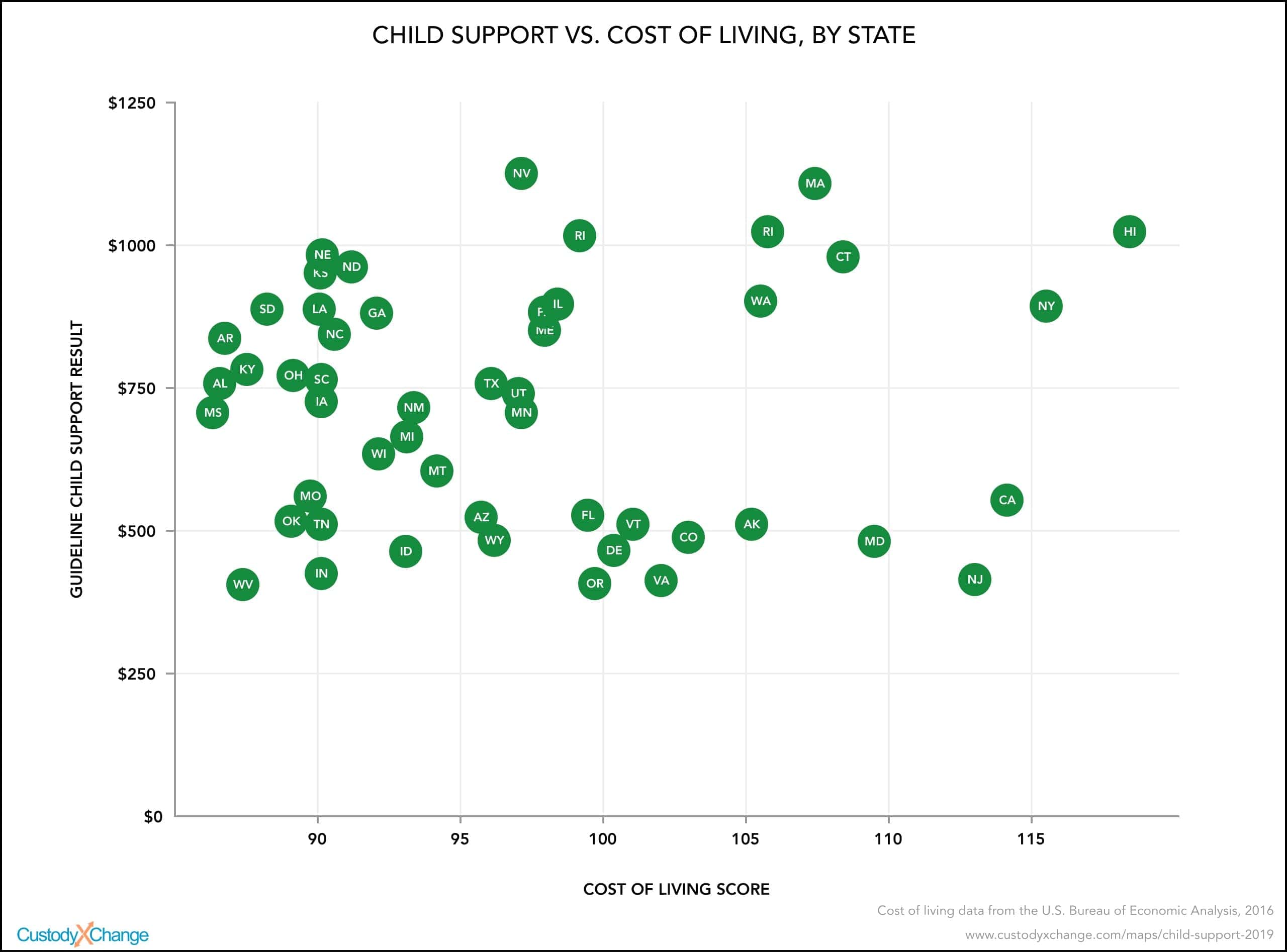

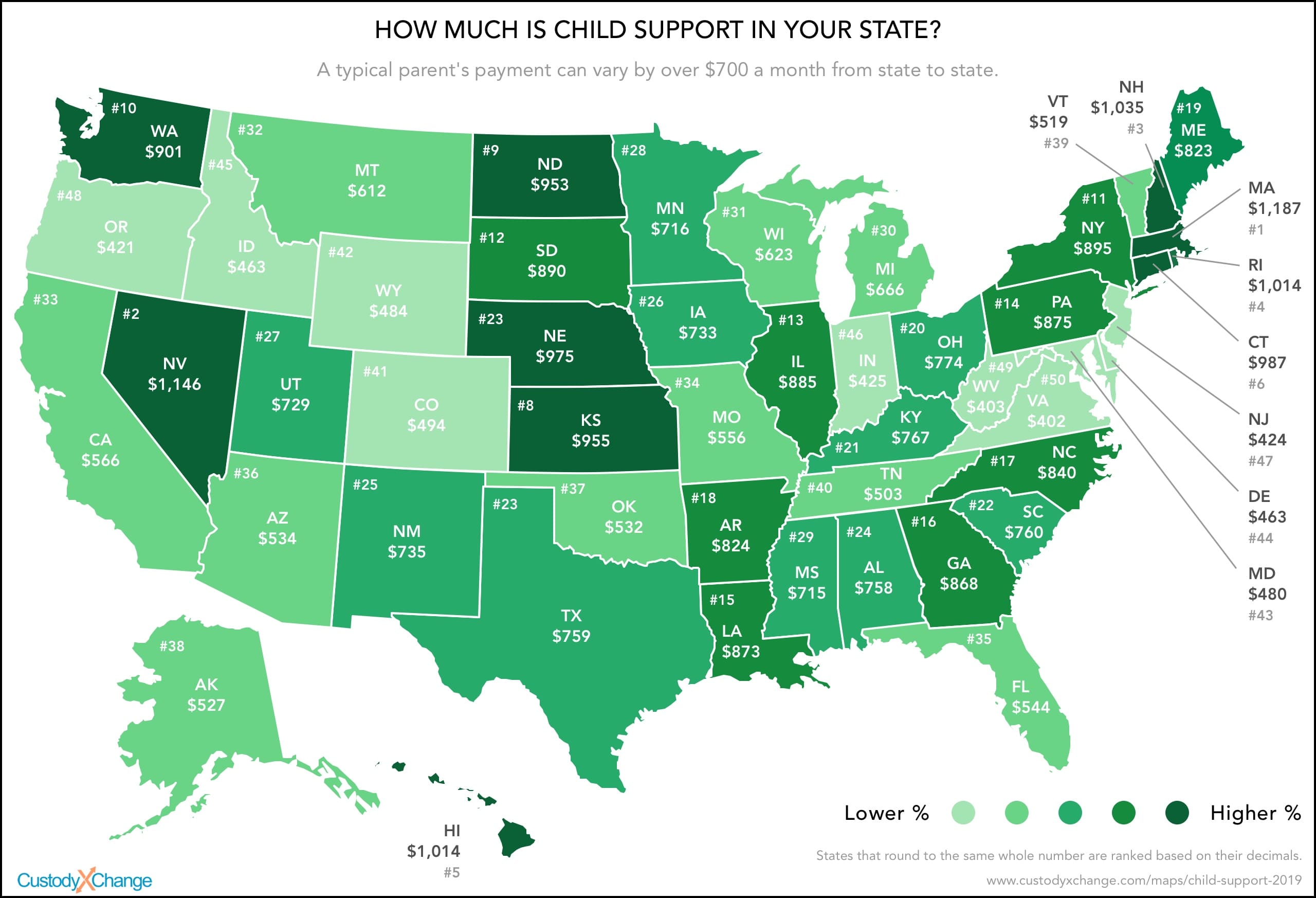

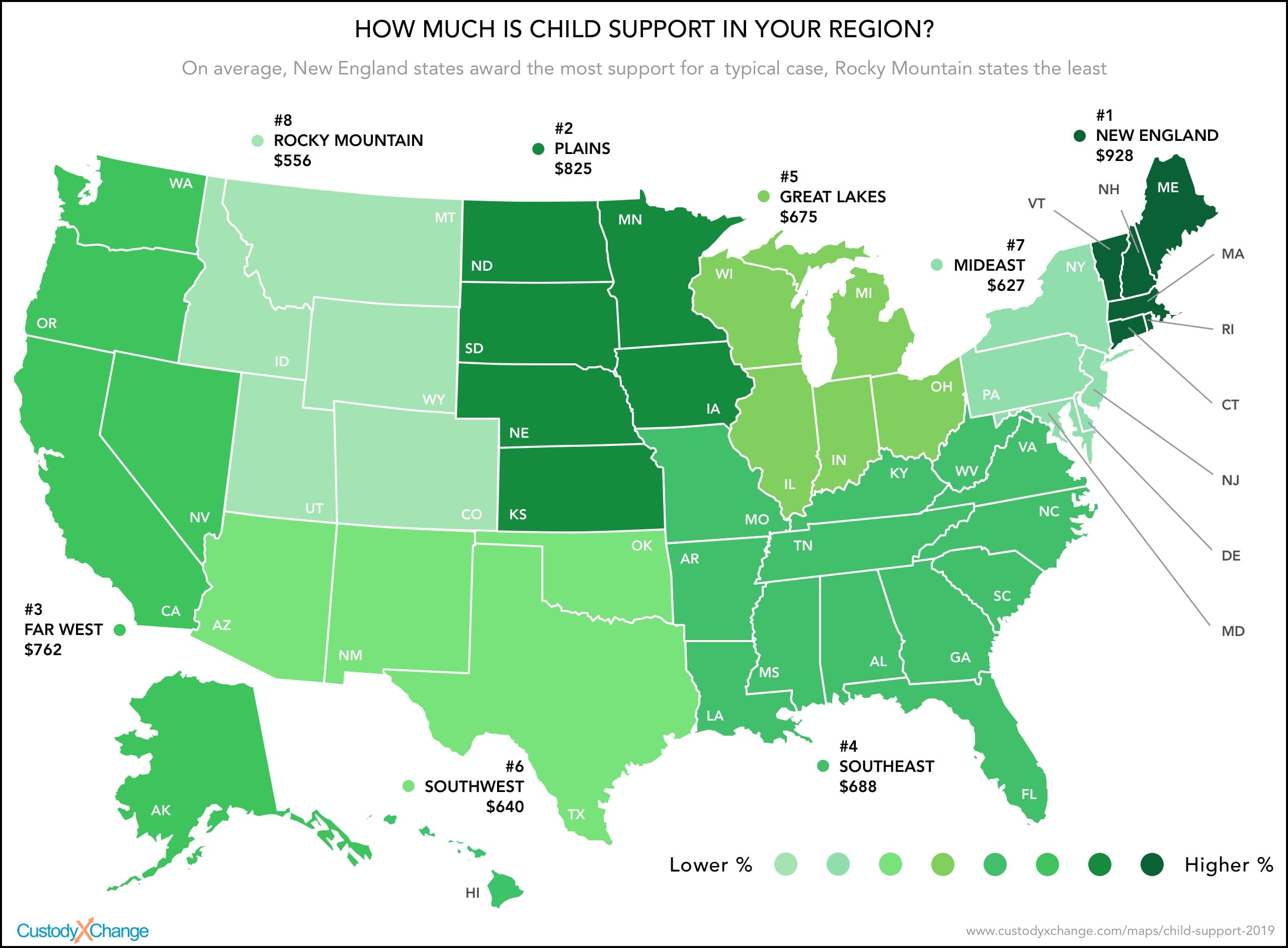

How Much Is Child Support In Your State Custody X Change

The child support guidelines will go on its maximum when both parents combined income is above 30000.

. If your employee has multiple IWOs and cannot pay all the obligations in full you will need to prioritize which FSR account will receive payment. House Bill 19-1215 changed the existing requirements for child support in a variety of ways in 2019 and 2020. Child support payments in Colorado are calculated using the income shares method.

Most importantly the law reduces the number of months that a Colorado court will presume a newborns caretaker will not work after birth from 30 months to 24 months. Each parents gross income is placed into the formula. Your choice is how many of your childs expenses you believe are included in this amount.

To ensure your financial and legal rights remain protected do not hesitate to text us at 720 730-4558 or call us at 720 463-4333 today. The legislature recognizes that the. 14-10-115 Colorado Child Support Guidelines has been updated three times in the last five years.

Child support is a court order requiring one spouse to pay the other for a childs basic expenses after a divorceMost divorces involving children end with one parent having to fulfill a child support order until the child turns 19 or older with some exceptions. Income Part 1 In Colorado numerous factors go into calculating child support. The support amount after factors are considered is called the presumptive amount.

Colorados Schedule of Basic Child Support Obligations sets this amount. Under Colorado Revised Statutes Section 14-10-115 a parents adjusted gross income refers to his or her gross income minus pre-existing child support and alimony obligations. Therefore the non-custodial parent pays 500 per month in child support.

The starting point for determining the child support payments in Colorado is the pre-tax income of each parent. Overtime is not considered gross income unless it is required as part of employment. 1 monthly income of both parties.

If the employees past due child support is more than 12 weeks old withhold 60 of the disposable income. Payments depend on the combined incomes of the parents as well as the number of children. An overview of how child support is determined in Colorado.

1 - Basic Expenses. 4 work and education related child care costs. What Does Child Support Cover in Colorado.

Other customary expenses which the parents expressly include. This article examines what Colorado considers as income in determining child support obligations. As a non-custodial parent the one who cares for the child less than 50 of the time you will be required to pay child support to the other party the custodial parent.

The main factors include. 3 annual overnights with each parent. Gross income before taxes of both parents The childs income if any Number of overnights the child spends with each parent Expenses including health insurance and daycare Other child support orders financial support given to children the parent may have with another partner and any alimony that may be due or received.

The Basics You Should Know About Child Support Calculations in Colorado. 5 the children. If the divorcing parents make more than 30000 combined per month the judge has the discretionary power to award support as if their combined income were exactly 30000 per month.

Under Colorado law the amount of child support that is determined in a child support action is typically tied to the income of the parties. The court orders a flat percentage of 25 of the non-custodial parents income to be paid in child support to the custodial parent. When the obligors the parent ordered to pay child support monthly adjusted gross income is equal to or less than 650 the Guidelines provide for a minimum order of 10 per month regardless of the number of children between the parties and regardless of how many overnights each parent cares for the children.

Posted in Child Support on August 25 2020. Child support is calculated using three major factors. If the non-custodial parents monthly income changes the dollar amount they pay in child support will change as well.

Calculation of the gross income of each parent gross income being income from any source other than child support payments public assistance a second job or a retirement plan. The table identifies the amount of support owed by parents given every monthly combined income starting at 100 and goes all the way to 30000mo at 50 increments. Some factors considered in a support calculation include.

Colorados Child Support Guidelines The guidelines represent a formula based on what the family would have theoretically spent for the childs care had the parties not separated. The more income a party has the greater is their share of support obligation. Child Support For High Income Earners The Guidelines are long.

Child support is a percentage roughly 20 for 1 child and an additional 10 for each additional. Judges have the ability to deviate from. The Colorado family court maintains that 30000 in combined income per month is the upper limit for determining child support.

If you are a salaried or full-time hourly employee this is relatively simple. If the employees past due child support is less than 12 weeks old please withhold 50. The court would apply for the supportive orders if the parents had an exact income of 30000.

It is important to understand exactly what the law considers income when determining a child support award. How Child Support is Calculated in Colorado. The Colorado law on child support is always evolving.

Depending on the circumstances it is possible for social security benefits retirement benefits loan proceeds and stock option sales proceeds to also be considered income in terms of child support. A primary concern you likely have is how to calculate income for child support and alimony in Colorado and the experienced family law attorneys at Johnson Law Group can help you with that. What is not included is said to be an extraordinary expense.

So what happens to high income earners fortunate enough to make a combined income of more than 360000yr. This includes a 2018 change to how the courts define adjusted gross income and alimony or maintenance received.

Colorado Child Support Calculator 2022 Simple Timtab

Child Support Basic Obligation Colorado Family Law Guide

How Much Is Child Support In Your State Custody X Change

Does Child Support Increase If Salary Increases Goldman Law Llc

Child Support An Essential Guide 2022

Understanding And Calculating Alimony In Colorado Divorcenet

Frequently Asked Questions Colorado Child Support Services

How Much Is Child Support In Your State Custody X Change

Child Support Financial Laws Responsibilities

Do I Need A Lawyer For Child Support Findlaw

Frequently Asked Questions Colorado Child Support Services

How To Modify A Child Support Order In Colorado

Oklahoma Child Support Divorcenet

Child Support An Essential Guide 2022

Colorado Separation Agreement Template Separation Agreement Template Separation Agreement Dissolution Of Marriage

Child Support Modification Termination Colorado Family Law Guide

Emancipation For Colorado Child Support Colorado Family Law Guide